Danaher: A Global Leader in Bioprocessing

Written by Christopher De Sousa, CIM® | Associate Portfolio Manager | www.marnoa.ca

Danaher Corporation is a leading global life sciences and diagnostics company that contributes to the discovery, development, and manufacturing of life-changing drugs and therapies. Danaher may not be a familiar name to many, but the company’s products and services subtly play a part in people’s lives.

Danaher’s diagnostics business enables more than 1.5 million cancer diagnoses every week. Danaher’s biotechnology business supports more than 90% of the global production volume of approved monoclonal antibodies (e.g., immunotherapies to treat cancers). And 75% of companies that received FDA approvals for cell and gene therapy drugs in 2022 relied on Danaher’s genomic medicine businesses. Danaher sells a broad range of instruments (e.g., microscopes, centrifuges, cell counters, etc.) and single-use consumables (e.g., reagents, pipettes, tubes, plates, filters, etc.) that help scientists in lab settings to research, develop, and manufacture biological medicines.

In 1984, the Rales brothers, Steven and Mitchell, founded Danaher as a collective of manufacturing businesses that included power tool producers Craftsman and Matco Tools. Throughout the 1980s, Danaher transformed into a diverse industrial conglomerate by strategically acquiring and integrating various manufacturing businesses. Inspired by Kaizen—a Japanese business philosophy emphasizing continuous improvement—Danaher implemented lean manufacturing practices to enhance profitability and cash flow across its operations. This approach culminated in the creation of the Danaher Business System (DBS), a guiding framework that continues to shape the company’s culture to this day. Danaher started to reinvent itself over the subsequent decades. Starting in the mid-2000s, Danaher carved out leadership positions in the life sciences and diagnostics markets. This strategic pivot into clinical lab settings started with the acquisitions of Radiometer (blood gas analyzers) in 2004 and Leica Microsystems (microscopes and scientific instruments) in 2005.

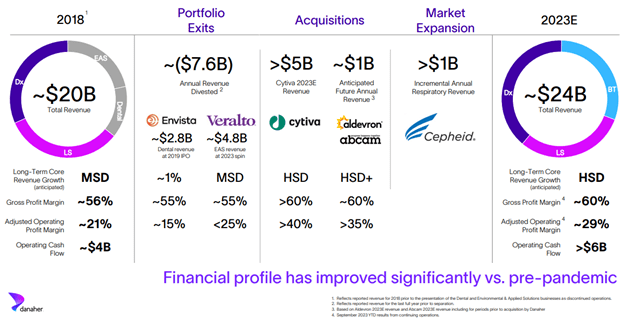

Danaher would complete over $50 billion in acquisitions focused on the life sciences, diagnostics, and biotechnology end-markets over the next two decades. Notable acquisitions included Beckman Coulter (diagnostic research equipment) in 2011, Pall (filtration, separation, and purification solutions) in 2015, Cepheid (molecular diagnostics) in 2016, and Cytiva (bioprocessing technology) in 2020. Over that same period, Danaher continuously offloaded non-core assets through divestures and tax efficient spin-offs. Notable spin-offs included Fortive (industrial instrumentation and equipment) in 2015, Envista (dental equipment) in 2018, and Veralto (water and product identification) in 2022.

Danaher leveraged the cash windfall from the immediate testing, vaccine, and therapy revenue opportunity during the Covid-19 pandemic to acquire Aldevron (provider of nucleic acids and proteins) in 2021 and Abcam (provider of antibodies and reagents) in 2023. Danaher expects that, together, Aldevron and Abcam will achieve high-single digit growth and produce an annualized revenue of $1 billion at a high profit margin.

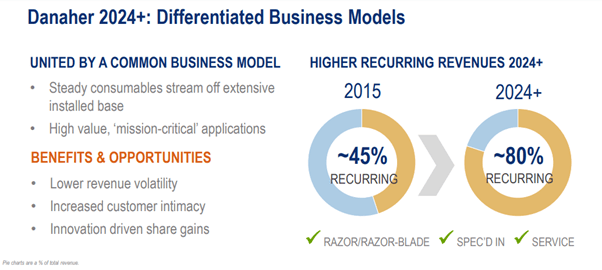

Danaher today operates a razor-and-razorblade business model characterized by lower revenue volatility, good earnings visibility, and higher-margin recurring revenue (~80%—up from ~45% in 2015). This is a far cry from the cyclical business model in the 80s. By exiting Envista and Veralto, Danaher replaced over $7.5 billion of revenue which was dilutive to both growth and earnings with high-margin growth companies (e.g., Cytiva, Aldevron, and Abcam) that are exposed to robust secular growth trends in biologics (e.g., monoclonal antibodies, cell and gene therapy, and mRNA). We believe Danaher is poised to win more market share and become the end-to-end provider of tools and technologies for biologic therapies.

Over the long term, Danaher expects its core revenue to increase by high-single digits and its earnings per share to grow by double digits. We believe that Danaher will facilitate this growth through R&D investments and strategic M&A in life sciences, diagnostics, and biotechnology.

Source: Danaher slide presentation at J.P. Morgan Healthcare Conference on January 9, 2024.

MSD = Mid-single digit. HSD = High-single digit.

High switching costs and regulatory moat

Danaher operates in a highly regulated industry. In the process of developing biological drugs, certain instruments and/or consumables are utilized during the clinical and development stages. These components are specified (or spec’d) in the drug design protocol and included in the regulatory filing submitted to the Federal Drug Administration (FDA) for approval. If the FDA gives the green light to the protocol, then the spec’d-in instruments and/or consumables are then employed by Contract Manufacturing Organizations (CMOs) during the commercial production stages of the biological drug.

Once the drug progresses to Phase 3 trails or commercial manufacturing, the spec’d-in components are almost unchangeable. The costs and potential regulatory hurdles linked to substituting a spec’d-in component can be prohibitively high. FDA-approved processes and validated protocols can cost biopharma firms (e.g., Pfizer, Moderna, Merck, J&J and others) millions of dollars and a lot of time. If the biopharma firm decided to switch out a spec’d-in component for a new instrument and/or consumable, they would need to re-submit the updated specifications to the FDA. The FDA would have to re-examine the drug protocol which can take months or even mandate the reauthorization of the drug.

Even when presented with a less expensive alternative to the existing spec’d-in component, biopharma firms may hesitate to switch due to the considerable costs tied to regulatory compliance. In the grand scheme of things, the overall cost of instruments and consumables are relatively minor in comparison to the substantial value that they generate for biopharma firms. The combination of switching costs and regulatory hurdles cultivate long-lasting customer relationships and establish formidable barriers to entry for potential competitors. Danaher’s recurring revenue, predominantly derived from consumables, is indicative of its broad installed base. This revenue normally ranges between two to five times that of instrument revenue on an ongoing basis. Consumables are commonly tied to long-term contracts which make them a relatively stable and predictable source of revenue. Putting it all together, Danaher has an outstanding moat protected by high switching costs. Regulatory barriers further fortify the moat.

Source: Danaher Investor Day 2022

Inventory de-stocking

Do you remember when people stockpiled toilet paper during the pandemic? I do—I was one of them. People were panic buying a month or even six months’ worth of toilet paper to avoid the fate of being stuck with one square. But it didn’t stop at toilet paper. People loaded up on other household necessities like medical supplies and food. Well, this too happened in the biopharmaceutical industry.

Biopharma firms stockpiled on instruments and consumables that were mission critical to the discovery, development, and manufacturing of drugs and therapies. First, many of Danaher’s customers were involved in addressing the pandemic, either through diagnostic testing or the development and production of mRNA vaccines. This ignited demand for the company’s offerings. Secondly, the disruptions in the global supply chain contributed to longer lead times for raw materials and components. In response to increasing demand levels, longer lead times, and capacity concerns, biopharma firms began to over-order and stockpile instruments and consumables.

Biopharma firms typically stock around six months of inventory, but during the pandemic, that number increased to 12 months or more. Consequently, the frequency of orders escalated from a monthly basis to a weekly basis. Industry-wide, biopharma firms ensured they had adequate inventory to develop Covid-19 vaccines but as well as therapies for cancers and other diseases. The over-ordering ultimately contributed to an inventory glut when demand dropped off for covid-19 vaccines. Many biopharma firms have either reduced order sizes or halted orders over the past 12 to 18 months as they work through their excess inventory.

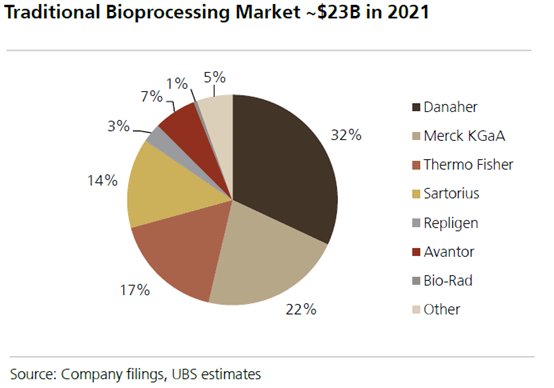

As a result, revenues at Danaher and other tool suppliers have been negatively impacted by inventory de-stocking. That said, Danaher this month shared anecdotal evidence of customers coming back to regular ordering patterns. And last week, Sartorius, one of Danaher’s close competitors, reported a sequential recovery in order intake as well as a book-to-bill ratio of 1.02x in Q4. Book-to-bill is a ratio of orders received to the amount billed for a specific period. A ratio above 1 supports an improved sales and demand outlook.

We think the timeline or “inflection point” for inventory normalization will come much sooner than expected. For the long-term investor, the issues in the market are short-term and transitory. We don’t believe they are structural or disruptive to the long-term growth of the biologics market. There is strong demand for the development of biological drugs and therapeutics, and the size of the biologic development pipeline (>20,000) continues to grow across modalities (e.g., monoclonal antibodies, cell and gene therapy, and mRNA).

Large opportunity in biological drugs

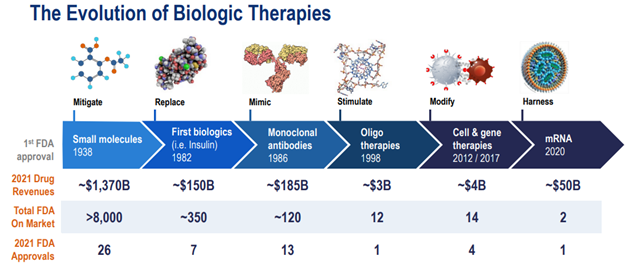

As we all know, the cost today for the research and development (R&D) a new drug has significantly increased over the few decades. Deloitte studied the top 20 global biopharma firms and found that the average cost of developing a drug—from discovery and clinical trials to bringing the drug to market—is estimated to be approximately $2.3 billion. In 2003, the cost to develop a new drug in a Tufts University study was estimated at $800 million ($1.3 billion in 2023 dollars). The surge in the development of large cell molecule medicines, known as biologics, is a significant factor in the escalating costs of research and development. This is because biologics are approximately 25% more expensive to produce compared to small molecule drugs.

Currently, biologics make up about 60% of all drugs being developed, a substantial increase from just 20% in 2002. Small molecule drugs are often ingested orally (e.g., Tylenol and Aspirin), whereas biologics (e.g., immunotherapy) are often administered through intravenous (IV) or injection. Biologics are much more targeted in their treatments.

Danaher is a direct beneficiary of rising R&D budgets. Recall Danaher supplies the so-called “picks and shovels” across each stage of development, from R&D to commercialization (>75% of Danaher bioprocessing revenues come from Phase 3 or later). Bioprocessing, which is the production process of using living cells/organisms to produce biologics, as a market, is expected to grow high-single digits long-term, but there are modalities growing much faster. The cell and gene therapy market, a subset of biologics, has witnessed a tenfold increase in the development of genomic medicines since 2015. This market is anticipated to grow by over 30% in the next five years. The development pipeline for monoclonal antibodies (mAbs), another subset of biologics, is expected to see double-digit growth over the same period (>90% of all approved mAbs use Danaher’s bioprocessing offerings).

Biologics are still relatively small when compared to the small molecule market. Advancements in technology and innovation have accelerated biologic therapies over the past decade. Source: Danaher Investor Day 2022

The IQVIA Institute forecasts that the global medicine market will expand at a compound annual growth rate of 5-8% through 2028, reaching a total value of $2.3 trillion, as more patients gain access to improved treatments. Over the past five years, global medicine usage has increased by 14%, and it’s projected to rise by an additional 12% through 2028, bringing annual use to 3.8 trillion defined daily doses. As the market expands, we expect that growth to flow-through to leaders in bioprocessing such as Danaher and enhance their already substantial market share.

Risks include 1) Prolonged customer inventory de-stocking, 2) Lack of funding for biopharma, 3) Restrictive capital markets, 4) Supply chain disruptions could return, and 5) Competition in the life sciences, diagnostics, and biotechnology markets.

Please click on the button below to subscribe to our mailing list.

By subscribing, you will get regular commentary about our portfolio holdings, market outlook, financial planning, and events. You can withdraw from receiving emails at any time by unsubscribing.

Disclaimer

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Christopher De Sousa, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.