LVMH: The World's Largest Luxury Group

LVMH Moët Hennessy Louis Vuitton is the world’s largest luxury goods conglomerate that owns a collection of 75 brands—or “Maisons”—including Louis Vuitton, Christian Dior, Dom Pérignon, Tiffany & Co., Hublot, and Sephora. Many of LVMH’s brands are known for their rich history and long-lasting legacy. The oldest brand dates to 1593—winemaker Château d'Yquem—followed by Ruinart—the world’s first Champagne house established in 1729.

A brand’s heritage is a product of time and cannot be replicated. This in of itself is a formidable competitive asset as a brand must survive for decades or centuries to leverage that heritage. Moreover, LVMH’s success is deeply rooted in cultivating a culture of creativity, craftsmanship, and quality. These values serve LVMH the foundation to enhance the desirability of its brands which customers can trust and are willing to pay premium prices for.

LVMH is a high-quality business with strong competitive advantages, which stem from:

- Unparalleled scale in retail and marketing,

- Market share leadership in each of the five categories in the luxury goods market,

- The ability to raise prices,

- Brand heritage creating high barriers to entry, and

- A best-in-class portfolio of brands that embodies heritage, longevity, and desirability.

LVMH has grown sales and operating profits at an average annual growth rate of about 11% and 15%, respectively, over the past ten years. This growth is partly attributable to price increases and selective mergers and acquisitions of prestigious brands over that period—including Bulgari (acquired in 2011), Loro Piana (2013), Rimowa (2016), Christian Dior Couture (2017), and Tiffany & Co. (2021).

In the luxury market, the high barriers to entry have invariably made mergers and acquisitions a fundamental growth strategy. Creating a new luxury brand is not easy as heritage cannot be built overnight. A strategic way to grow is by acquiring reputable brands—which is an integral part of the LVMH playbook. In fact, LVMH was established in Paris through the merger of Louis Vuitton and Moët Hennessy in 1987. Moët Hennessy itself was the product of a merger between Moët & Chandon and Hennessy in 1971.

Since then, LVMH has purchased a number of renowned brands—including Givenchy (acquired in 1988), Berluti (1993), Kenzo (1993), Guerlain (1994), Celine (1996), Loewe (1996), Marc Jacobs (1997), Sephora (1997), Tag Heuer (1999), Emilio Pucci (2000), Fendi (2001), and many more. Each brand is managed separately and independently with their own chief executive and creative director. This decentralized decision-making and operating structure is instrumental to the group’s success in building unique and innovative brands and experiences that resonate with consumers.

LVMH chairman and chief executive Bernard Arnault told CNBC in 2018, “In the 90s, I had the idea of a luxury group and at the time I was very much criticized for it. I remember people telling me it doesn’t make sense to put together so many brands. And it was a success…And for the last 10 years now, every competitor is trying to imitate, which is very rewarding for us. I think they are not successful, but they try.”

LVMH continues to be highly active in the consolidation of the luxury sector as evidenced by the $15.8 billion purchase of American jeweler Tiffany & Co. in 2021. LVMH has successfully revitalized Tiffany’s brand strategy and financial trajectory by more than doubling sales since the takeover. Prior to joining LVMH, Tiffany sales were increasing at an average annual growth rate of 1.5% between 2015 and 2019. LVMH hopes to replicate the turnaround strategy applied to Bulgari at Tiffany. Italian jeweler Bulgari was acquired by LVMH for $5.2 billion in 2011. Bulgari has experienced significant growth under LVMH, with revenues doubling and profits increasing five-fold since the acquisition.

LVMH manages five business divisions across all the major segments of the luxury industry—including fashion and leather goods, wines and spirits, perfumes and cosmetics, watches and jewelry, and selective retailing. LVMH’s largest division is fashion and leather goods—home to megabrands Louis Vuitton and Christian Dior—brings in almost half of the group’s sales and three-quarters of the group’s operating profit. Over the past decade, the fashion and leather goods division has experienced double-digit organic sales growth due to resilient growth at Louis Vuitton (e.g., doubling sales between 2018 and 2022) and Christian Dior (e.g., tripling in size in less than seven years).

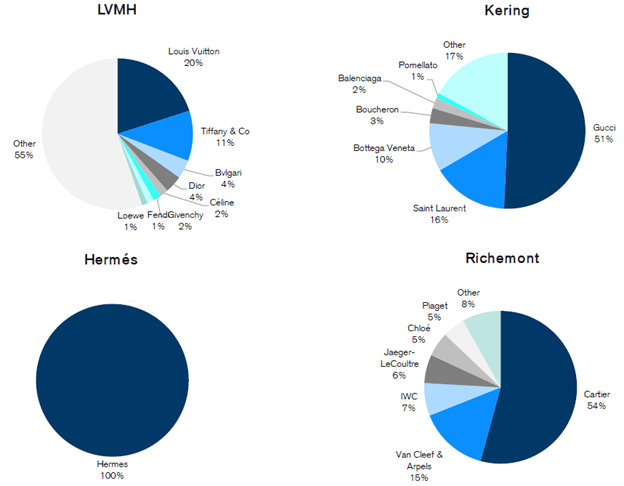

In recent years, LVMH has made significant strides against its competitors, nearly doubling its global market share from 12% to 22% in the period from 2018 to 2023. LVMH is the most diversified luxury goods company with leadership positions in all major categories of the luxury market, giving it a less cyclical profile. For example, LVMH’s top six brands—Louis Vuitton, Christian Dior, Tiffany, Sephora, Hennessy, and Bulgari—are estimated to represent 70% and 85% of the group’s sales and operating profits, respectively. In comparison, two other luxury conglomerates, Kering and Richemont, rely heavily on Gucci and Cartier, respectively, with both brands accounting for half of each group’s sales (refer to the chart on the next page for reference).

Despite the potential risks to the macroeconomic environment and consumer sentiment, we maintain an optimistic perspective on the long-term fundamentals of LVMH and the broader luxury goods market. The global luxury goods market is estimated to grow to 530 to 570 billion euros by 2030—more than 2.5 times higher than the market size in 2020. Much of the growth is expected to be driven by new wealth creation, rising incomes, and expanding middle-classes in the U.S., Europe, and China.

LVMH is a family-run group. The Arnault family owns 48% of LVMH’s capital. All five of Bernard Arnault’s children hold high-level management positions at brands in the company. The family’s investment and involvement often referred to as “skin in the game” demonstrates a commitment to the longevity of the firm. But above all, the long-term success and prestige of LVMH is ingrained in the rich lineage and heritage of its brands.

Key chart: Sales by Brand

LVMH is more diversified vs. largest competitors.

Source: Euromonitor, Credit Suisse research

Please click on the button below to subscribe to our mailing list.

By subscribing, you will get regular commentary about our portfolio holdings, market outlook, financial planning, and events. You can withdraw from receiving emails at any time by unsubscribing.

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Christopher De Sousa, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.