How U.S. Federal Taxation Changes in 2024 Could Affect You

WONDERING WHAT CHANGES THE NEW YEAR BRINGS TO YOUR TAX SITUATION?

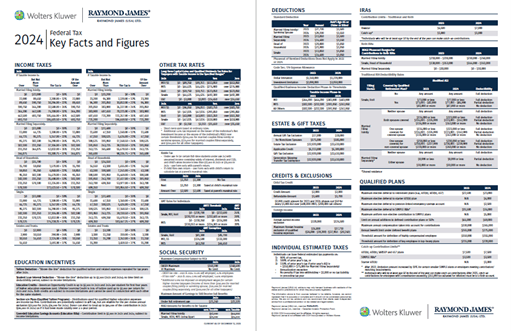

Check out the guide on 2024 U.S. federal tax: key facts and figures.

(Click image to download a copy)

New year, new taxes.

As you usher in a new year, it’s not just resolutions and fresh beginnings that should be on your mind.

To help you navigate the 2024 U.S. federal tax landscape, we’ve summarized key information - focusing on federal income tax, Individual Retirement Accounts (IRAs) contribution limits, deductions and estate and gift taxes.

Explore our cross-border services

Simplify your cross-border investments

Increased IRA Contribution Limits

It’s never too early to plan for the future, especially when it comes to your retirement. One way to effectively do so is by strategically contributing to your IRA. The sooner you start contributing, the longer your money has to grow – potentially yielding bigger returns.

For 2024, the IRA contribution limit has increased to $7,000 – providing you with more opportunities to build a tax-deferred nest egg.

Catch-up Contributions for Individuals Aged 50 or Older

If you’re 50 years old or above at the end of the year, the good news is that the catch-up contribution limit remains at $1,000. This allows individuals in this age group to contribute a total of $8,000 to their IRA accounts in 2024.

Taking advantage of catch-up contributions can help you boost your retirement savings, especially if you haven’t maximized your contributions in previous years.

Reviewing Key Financial Planning Figures

Whether you’re a seasoned investor or just starting, it’s important to review key 2024 planning figures across federal income tax as well as estate and gift taxes. We can help you understand those figures, so you can make informed financial decisions that align with your lifestyle and retirement goals.

Whether you’re focusing on retirement planning, income tax optimization or estate planning, reach out to our team for personalized guidance tailored to your unique financial situation.

Do you need assistance with cross-border investments and financial planning?

Our cross-border financial advisors are experienced in helping Canadians and Americans with investment and retirement accounts on both sides of the border.

Raymond James (USA) Ltd. advisors may only transact business with residents of the states and/or jurisdictions for which they are properly registered. The information above is from sources believed to be reliable, however, we cannot represent that it is accurate or complete and it should not be considered personal tax advice. We are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related and legal matters.

Raymond James (USA) Ltd., member FINRA / SIPC.